igi share price: LIVE BLOG

International Gemmological Institute Share Price Live (igi share price): IGI shares fall 6% post debut; stock lists at 22% premium.

International Gemmological Institute Share Price: The IGI IPO, which included a fresh equity sale of Rs 1,475 crore and an Offer for Sale (OFS) of 6.59 crore shares, received a strong response from investors, with the issue being oversubscribed 35 times by the close.

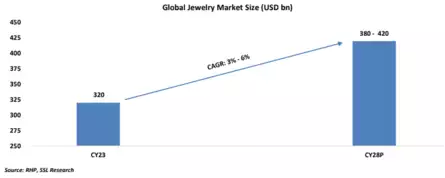

International Gemmological Institute Share Price: Global jewellery market size

The global jewelry market, valued at USD 320 billion in 2023, is projected to grow at a 3%-6% CAGR, reaching USD 380 billion to USD 420 billion by 2028, driven by demand for daily wear jewelry and innovations in design and online retail.

International Gemmological Institute Share Price: Directors Profile

Bimal Tanna is the non-executive Chairman and Independent Director of Company. He holds a bachelor’s degree in commerce from University of Bombay. He is a member of The Institute of Chartered Accountants of India (“ICAI”). He worked from 2002 till his superannuation in 2023 with PricewaterhouseCoopers Private Limited and

other PricewaterhouseCoopers (“PwC”) entities in India which are member firms of the PwC network; during this period, he was designated as a partner.

IGI is the first organisation for certification and accreditation to be listed and that itself is a big move. The other thing is lab-grown diamonds are very affordable and everyone aspires to have a diamond and today, instead of buying some imitation, they have the option of buying an actual diamond and IGI has taken the lead in the lab-grown sector and we want to propagate both types of diamonds – natural as well as lab-grown.

– Tehmasp Printer, MD & CEO, and Eashwar Iyer, CFO, IGI (India)

International Gemmological Institute Share Price: Industry Overview: India

The Indian Jewelry Market stood at USD 64 bn in CY23 and is expected to reach USD 100 bn to USD 115 bn by CY28P, growing at a CAGR of 11% – 13% between CY23 to CY28P driven by rapid urbanization and increasing discretionary spending of individuals.

The Jewelry market in India is largely dominated by gold representing ~87% of the total Indian jewelry market,

however the share of gold in the overall market is expected to reduce in the future to 70%-75% by CY28 as other categories like diamonds, gemstones are becoming more prominent.

Further, the market share of the organized sector has improved from ~2% in CY10 to ~35% in CY23, which is further expected to grow to 40%-50% by CY28P, driven by supply-side reforms like mandatory gold hallmarking and introduction of GST etc.

International Gemmological Institute Share Price: Industry Overview: Global

The Global Jewelry Market was valued at USD 320 bn in CY23 and is expected to grow at a CAGR of 3%-6% between CY23 to CY28P to reach USD 380 bn to USD 420 bn by CY28P.

The growth is likely to be driven by both demand and supply side factors including emergence of daily wear jewelry and acceptance of various colored gemstones on the demand side and innovation in designs and growth in online retail on the supply side.

Further, the rising acceptance and use of jewelry by men is driving demand for products like cufflinks, gold chains, etc which in turn fueling market expansion.

(Source: SBI Securities)

International Gemmological Institute Share Price: Post-issue shareholding pattern

International Gemmological Institute Share Price: Company’s growth strategies

- Maintain leadership position in certification of laboratory-grown diamonds.

- Expand presence in natural diamond, studded jewelry and colored stone vertical market.

- To expand global laboratory network.

- Continue to invest in building brand salience.

- Leverage strength in education to increase awareness as well as build trust and transparency.

- Continue to invest in technology including AI to improve processes.

THANK YOU

you are really a good webmaster. The site loading speed is incredible. It seems that you’re doing any unique trick. Moreover, The contents are masterwork. you have done a fantastic job on this topic!